In this article, we’re going to talk about something so foundational to the practice of accounting and bookkeeping that its importance is easily overlooked: the Chart of Accounts (CoA). I mention it a lot in my industry profile articles, so I wanted to be sure I explain what the heck it is so you can learn more as you’re reading about accounting for your Florida small business.

If you’re a small business owner who has tackled your bookkeeping at any point in time, you have worked with your Chart of Accounts and perhaps didn’t realize that’s what it’s called. Likewise, if you have ever seen a financial statement (e.g., Balance Sheet, Profit and Loss Statement), you have seen a CoA as it is what gives these reports their structure. And if neither of the above applies to you, you’re in luck because you will walk away from this article knowing what a Chart of Accounts is and how it can give you info you need about your business.

That said, we can’t talk about the Chart of Accounts unless we also talk about financial statements for small businesses! Let’s dive right in.

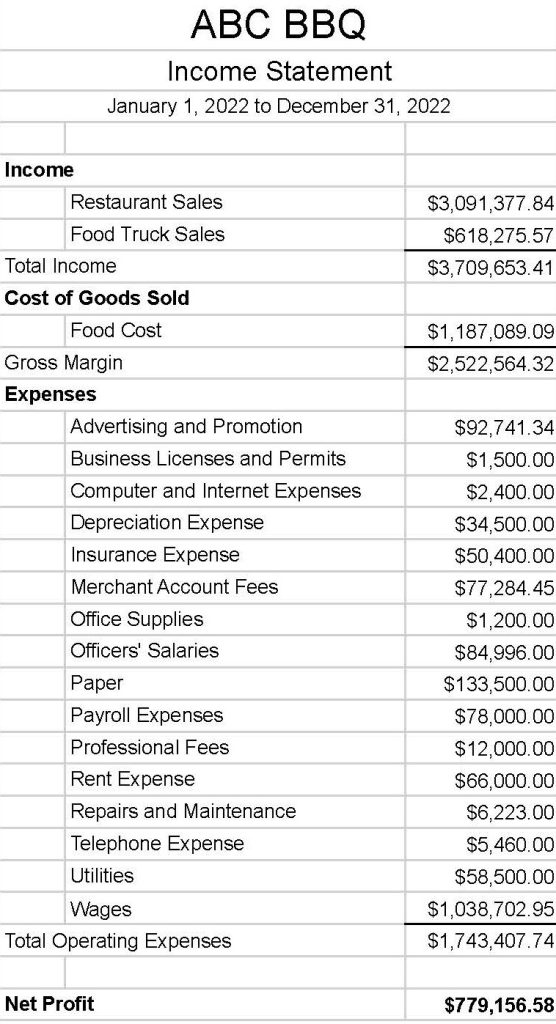

The Income Statement, aka Profit and Loss or P&L

If I could only look at one statement to tell me the most about the health of my small business, I would pick the Income Statement. Better known casually as the P&L, the Profit and Loss Statement tells you exactly that – how much you’re netting, be that a profit or a loss for your business.

The top portion represents the income you’re bringing in, preferably itemized by income stream, and the second part details the different categories of expenses. The last part, the ever-important “bottom line,” nets the two against each other so you’re left with (hopefully) a positive amount…a profit for your business. If the bottom line is negative, well, you need to increase your income or cut some expenses!

Here is an abbreviated P&L to illustrate how these look (this is actually taken from an SBA loan package I helped a company with, but I removed a few [a lot] of the lines to shorten it for our purposes here):

Notice that the P&L represents a period of time. The cool thing about this is that we can run reports in QuickBooks that show month over month or year over year so you can compare everything! You can see a year at-a-glance and look for trends that indicate seasonality, for example, or maybe a new manager took over and you can see an uptick in sales due to his good performance.

Each of the categories on this income statement are called accounts, and they stem from the general ledger – each are accounts in the ledger that can be looked at individually so you can track each category. You can look at just one of these to drill down and look for trends as mentioned above.

The Chart of Accounts, thusly, is basically a listing of each of these – a hierarchy of categories. The income in our example is divided into two sub-accounts, one for restaurant sales and one for food truck sales. You can imagine how important it is to easily check on how each stream of revenue is doing!

But wait! There’s more….

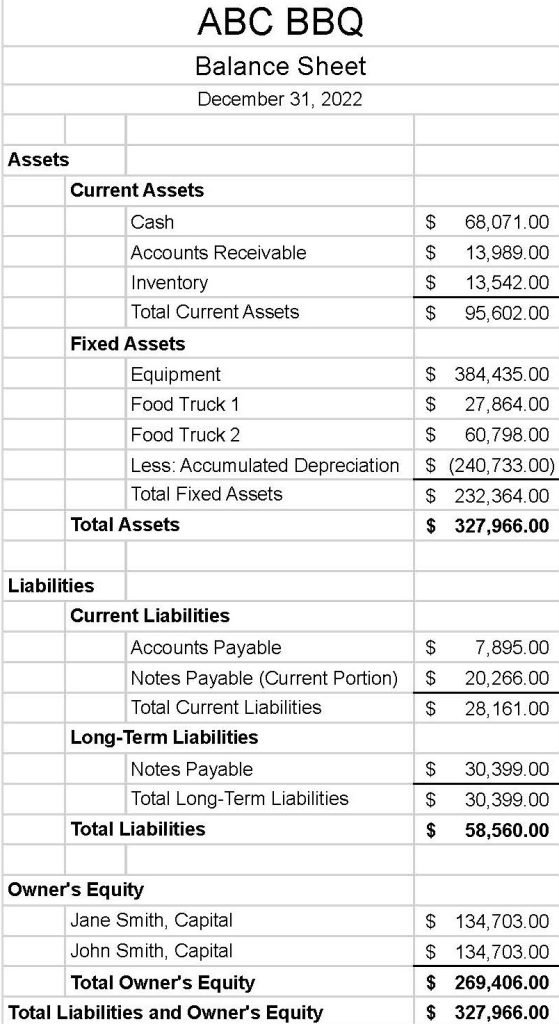

The Small Business Balance Sheet

The Balance Sheet is still very important to small businesses, but perhaps less so for those that do not own major assets or take out loans. Still, it is worth mentioning and reviewing here since at the very least, you have bank accounts and owner’s equity! And, it also contributes greatly to the Chart of Accounts as there are accounts that only apply to the parts that make up the Balance Sheet.

This financial statement details the fundamental accounting equation of Assets = Liabilities + Owner’s Equity. This equation forms the very basis of double-entry bookkeeping, but that’s too much of a tangent for right now.

Here’s a quick rundown of what’s included in each of these categories:

- Assets: Cash, accounts receivable (aka A/R – money you are owed for services rendered), fixed assets like a building you own or more expensive equipment. These are listed in order of liquidity.

- Liabilities: Credit cards, in-house accounts for vendors you pay later (accounts payable, aka A/P), mortgages, notes payable for vehicles or equipment you chose to finance. These are divided into current (will be due within the next 12 months) and long-term.

- Owner’s Equity: The amount of capital you’ve contributed to your business (adding contributions, subtracting owner’s draws) and what’s left over after accounting for that period’s profit or loss (and this is why the Balance Sheet is inextricably linked to the P&L!).

The Owner’s Equity account looks different than that of a corporation where there are stockholders who own a part of the company. The Balance Sheet for a small business is easier to interpret since there are no publicly-traded shares or treasury stock, etc. to account for.

Here is a Google Sheet sample, again, just a simplified example:

This statement tells you how much you truly own as a company on any given date. It is not over a period of time; it is just a snapshot in time. You can see that this BBQ restaurant has two food trucks, including one that is probably newer and has a loan on it. If Jane and John were to pay that loan off on January 1, the picture would be quite different!

Note also that as a small business owner, of course you can choose to put your profits back into your business, but there is no actual retained earnings unless you’re a corporation (and then you get to pay corporate taxes on that). For sole proprietors, partners, and LLCs, these profits will be taxed on your personal tax return each year and there is an adjusting entry made to distribute these profits to the respective owners’ capital accounts.

What did we add to our Chart of Accounts for the Balance Sheet? We saw income and expense categories on the P&L, and now we see the assets, liabilities, and equity accounts.

Customizing Your Small Business Chart of Accounts

So, what of it all? How does it impact you and how you run your business or handle your bookkeeping?

I wanted to write this to give a little more insight into why these financial statements are useful, but I really wanted to drive home the point that you can customize almost every one of these account names to reflect your unique situation to give you the maximum amount of info about your business. Here is how we go about that.

Income

Start by listing what sources of income you have for your business. This is easier if your business is already established, but not too hard as a startup if you have a good business plan. 😉 You want to differentiate these, but you also don’t want to get too crazy since it will just make your P&L long, which makes it harder to read.

Pick a couple of umbrella categories that you can drill down if necessary. Some businesses do not need to drill down, but you should use categories that could be further honed if necessary when possible. Here are a few examples I’ve written about in my industry profile articles:

- Caterers: Corporate clients, private parties, weddings

- Cleaning businesses: Residential (weekly, monthly, quarterly, one-off), offices, construction cleanup, rental turns (STR, long-term)

- Lawn and landscaping services: Residential, commercial contracts, one-off, landscaping jobs

- Daycares: Tuition (babies, toddlers and preschoolers, VPK, school age [after-school care, early morning care]), drop-in, special events, food income, other subsidies

- Pet care businesses: Hourly doggy daycare, boarding (daily rate, weekly rate), training income, grooming income, vet care income, product sales, boarding upgrades (extra time outside, special food needs)

- Photographers: Portraits (babies, families, headshots, maternity), events (weddings, birthdays, corporate), creative (street photography, landscapes, urban), product sales (albums, prints, framed art)

As you can see, some niches can be subdivided more than others, and I’ve taken a lot of liberty with this example just to show what can be done, but I wouldn’t suggest you drill down quite this much! Some of these would probably not even offer all of these things and are more likely to specialize in one or two of these service offerings.

Expenses

We need to repeat this process with expenses in a way that makes sense for your business. While there are certain categories that are necessary for tax time, you can have sub-accounts to your heart’s content.

Some examples in line with the above:

- Caterers: Food cost, paper (straws, to-go materials), food truck expenses (generator fuel, mobile Wifi, dump fees), wages and payroll expenses

- Cleaning businesses: Chemicals, disposable supplies, reusable supplies, small tools and equipment

- Lawn and landscaping services: Fuel for equipment, supplies (trimmer line, mower blades), small tools and equipment (pruners, string trimmer, edger, blower, fuel cans), materials costs (plants, mulch, rock, soil – these would be COGS)

- Daycares: Baby supplies (diapering supplies, linens), educational supplies (toys, books, arts and crafts), food cost, dumpster fees, utilities (electric, phone, wifi), employee wages

- Pet care businesses: Food (kibble, canned, treats – you could further divide this by type of animal if your facility is large), leashes and collars, toys (dog, cat), kennel supplies (poop bags, gloves, cleaning chemicals), utilities (water, electric, phone, wifi), grooming supplies (shampoo, bows and bandanas, combs, small tools like clippers), veterinary supplies (flea medication, heartworm preventive, eye ointment), wages (kennel staff, admin staff, janitorial), payments to contractors (trainer, on-call vet)

- Photographers: Gear and equipment (bags, straps, flashes, reflectors, umbrellas, tripods and stands), lenses and camera bodies under $2500 (see asset section below for more commentary), props (costumes, baby accessories, backdrops), wages and/or payments to contractors (assistant photographers, videographers, photo editors, product salespeople, MUAs and hair stylists), studio rent, COGS (your purchase price for anything you sell)

There are some items that almost every business will/should have, such as credit card processing fees and insurance, that I did not list here. These are simply meant as examples of businesses I am most familiar with, and even then, these lists are not exhaustive.

Assets and Liabilities

Assets are things that give your business value. They are owned (even if they are financed) and include things like your bank accounts, cash on hand, accounts receivable, vehicles, inventory, and furniture, fixtures, and equipment (FF&E) above a certain price threshold, typically $2500, that are meant to last at least a couple of years. As such, since they are not used up as quickly as other things you might buy that are considered expenses, they are depreciated over a period of time. The IRS has certain rules about useful life and accelerated depreciation that we won’t cover here, but the depreciation is considered an expense that reduces your tax liability until the asset is fully depreciated.

Here are some common assets you might see as a small business owner:

- Caterers: Most kitchen equipment, catering van, food truck or trailer, all inventory

- Cleaning businesses: Fleet vehicles, higher-value equipment like a floor buffer, supplies inventory, A/R

- Lawn and landscaping services: Mower, trailer, some equipment, A/R

- Daycares: Furniture and fixtures, any build-out, kitchen equipment, van or bus, supplies inventory

- Pet care businesses: Build-out, inventory for resale, supplies, building if owned

- Photographers: Camera bodies, lenses, and gear over $2500, inventory of props, studio/property if owned, any sets that have been built and furnished

Liabilities are made up of money you owe to others. These are pretty consistent across different types of business so here are some general examples:

- credit cards

- accounts payable

- notes payable

- loans payable

- mortgages

- payroll that has already been earned by the employees and not yet paid

- sales tax payable (doesn’t generally apply to service businesses in Florida, but there are some exceptions)

- deposits and payments from customers that haven’t been fulfilled yet (unearned income)

Owner’s Equity

We cannot forget the owner’s equity part of the equation (literally, the fundamental accounting equation: Assets = Liabilities + Owner’s Equity). We have established that there’s a capital account for each owner. On our Chart of Accounts, we would have sub-accounts under each person for their contributions and their draws. These net against each other to represent the total equity each has in the company, and the “retained earnings” at the end of each year are distributed to each according to the proportions that they own (in our example above, they are 50% partners).

Outsourced Accounting for Small Businesses

If all of this sounds like a lot to wrap your head around, you’re not alone! Your forte is your business, not necessarily accounting principles. I get it; I have been there in my own businesses when I was younger. But there is always a point in time where you’re growing and you start feeling the pinch on how to make the leap to working on your business full-time and not just as a side gig or supplementary income for your family. One of the ways you can do this is to free up some of the time you’re spending on the back-end of the business – marketing, office work, chasing after customers for payment, and yep, accounting!

Go ahead and check out my new accounting services price estimate tool to get a roundabout quote for how much services will run your business. When you’re ready to get started, schedule a quick call with me – this is your chance to get your questions answered and firm everything up. I can take over your books in under a week, freeing you up to focus on other things.

It is truly a pleasure to watch owners progress from that chaotic feeling of overwhelm that comes with growth to setting their sights on real goals they can accomplish when they are able to focus their energies on what they do best. You know your business and your niche better than anyone, and I am here to come alongside you and help you understand how your numbers are looking so you can make your business that much more profitable.