Caring for children is an admirable, stand-up occupation. Parents don’t send their kids off to just anyone, and you have earned their trust and built a wonderful place for children to attend. Owning a daycare facility (or any child care business, for that matter, like early learning centers and preschools) has a lot of moving parts – literally, with the kids! but also with the different aspects that go along with ownership. Daycare center owners usually have training in child care and put a lot of effort into which curriculum to use, which toys and educational items are best for their students, creating a schedule and routine for the children, and staying up to date with the latest in child care and education.

Your duties go far beyond that, however! Your role is not just operations; you are responsible for marketing, compliance, hiring and firing, dealing with parents and payments, and making sure the center’s bills get paid.

This article goes into some of the accounting areas that child care center owners struggle with. It can be very complex, especially if you’re running a large center. We will focus mostly on these types of facilities, but in-home daycare providers can also benefit from learning about daycare accounting, especially those with a goal of owning a center someday soon.

Handling Multiple Streams of Daycare Revenue

If you own a child care facility, you have likely come up with a plan to maximize how you use the building. This involves caring for various age groups as well as hosting events like a parents’ night out. You may also participate in the USDA food program (or the state program for Florida) as well as VPK or other subsidy programs that the government sponsors. Like I already said, there are a lot of moving parts! Your unique set of income streams is one of those areas.

It’s a good idea to break down your different areas of revenue into categories that make sense together when you are setting up your books. This helps you to break everything down on your P&L and see patterns over time. Common income categories and sub-categories for daycares include:

- Tuition

- Infants

- Toddlers and preschoolers

- VPK

- School-age

- Before-school care

- After-school care

- Special events

- Break week camps

- Summer camps

- Parents’ nights out

- Drop-in

- Overnight

- Field trips

- Food income

- Other subsidy income

- Fee and penalty income

- Late pickup fees

- Late payment fees

- NSF fees

- Transportation fee income

You probably won’t have all of these! But I wanted to give this example of how you can structure your income accounts on your Chart of Accounts.

Expenses for Daycares

Of course, running a business is not all fun and games, even though much of what you do does revolve around fun and games! 😉 We have to concern ourselves with expenses in order to run a profitable business, as you know. A daycare does incur many costs, and this will vary considerably based on the size of your center and your specific offerings.

Here is a sample of how you can organize and categorize everything, again with the goal being to break out different categories so you can see patterns, as well as keep an eye on expenditures:

- Advertising

- Ads

- Website

- Credit card and payment fees

- Educational supplies

- Arts and crafts supplies

- Books

- Games

- Toys

- Facility supplies

- Cleaning supplies

- Diapering and bathroom supplies

- Feeding supplies

- Food and beverage

- Furnishings and equipment (under $2500)

- Furniture and furnishings

- Indoor play equipment

- Outdoor play equipment

- Insurance

- Commercial auto

- Daycare-specific liability

- General liability

- Student accidental/medical

- Office and general supplies

- Payroll expenses

- Professional services

- Accounting

- Attorney

- Regulatory fees and licenses

- Repairs and maintenance

- Janitorial

- Lawn service

- Pest control

- Software

- Accounting software subscription

- Daycare CRM

- Training and continuing education

- Utilities

- Electric

- Gas

- Garbage pickup

- Water/sewer

- Wifi and internet

- Telephone

- Wages

- Childcare staff

- Office staff

- Payments to contractors

If you have a van or bus that you use for school pickups or field trips, a lease payment is an expense, while the interest on a loan payment for owned vehicles can be deducted along with a depreciation expense. An additional mileage expense can be taken at tax time (use a mileage log) OR you can expense fuel, repairs, and maintenance (requires more recordkeeping).

How you organize this will depend greatly on the level of detail you want to see. I could go even further with the one above, or we could do fewer sub-categories if it is too overwhelming for you to see it all drilled down like this – whatever works for your business.

Solving A/R Issues at Your Daycare

Almost all small businesses encounter issues with late payments or customers who do not pay for services they’ve received. This is unfortunately a more common occurrence with daycares. Part of the solution is to always get payment up front, with weekly and monthly payments making the most sense. You need a good invoicing system; QuickBooks Online can do this in and of itself, but another solution is daycare-specific software like Brightwheel that syncs with QuickBooks and gives you some additional functionality.

Putting parents on recurring automatic billing that drafts their account each week or month is arguably the best policy. Here’s why: ACH costs less for you than accepting cards, they are prepaying, and setting it up as automatically recurring takes some of the burden off of you for invoicing and all of the burden off of them for remembering to make the payment and following through!

That said, when one of your parents doesn’t pay for whatever reason and you still perform the services to allow them a grace period for the sake of the child, you are left with a receivable – they owe you money – otherwise known as A/R. It is a good idea to spell out in your contracts how this will be handled as far as cutting off services due to nonpayment! It will happen eventually, so let’s discuss how to account for it.

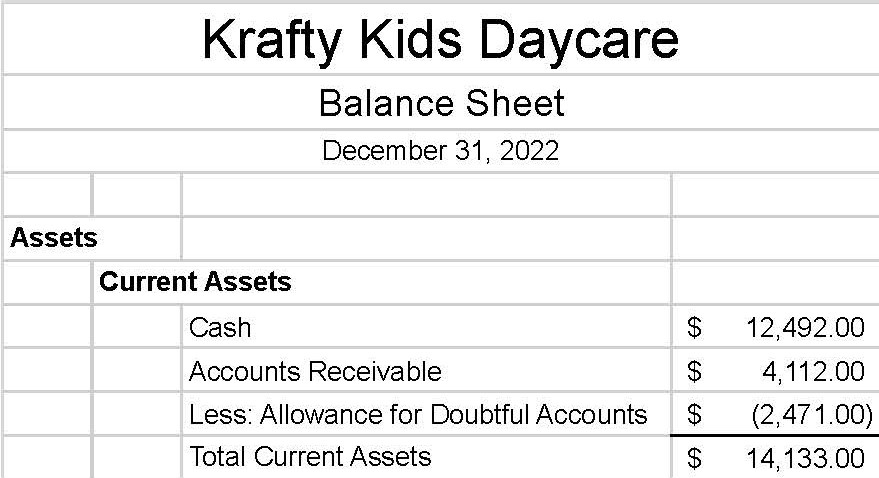

It would be wise to build in an Allowance for Doubtful Accounts (ADA) account when creating your Chart of Accounts. You can look at your historical percentage of uncollectible receivables to estimate how much to expect each year when it comes to how much revenue you can expect to lose due to nonpayment. The ADA account is what’s known as a contra asset account – A/R is an asset on your Balance Sheet, and the contra asset account subtracts from it. Here is how that looks:

This involves utilizing adjusting entries, which is a more advanced bookkeeping concept that I don’t suggest you try on your own without thorough research first. The gist of it is that the ADA account can be thought of as a declining balance for you to sort of “use up,” although, of course, it is preferable to NOT use it up and actually collect payment instead! 😉 You can reduce the risk of this with good policymaking and sticking to those policies.

When should you actually “write off” the unpaid amount? You can do so when it’s been determined that collection is not reasonably expected. This is simply a journal entry to remove that amount from the ADA account and also remove it from A/R so that specific customer’s debt to you is no longer reflected on your Balance Sheet. The “net realizable value” is actually still the same since you are removing the same amount from both A/R and ADA.

I know this is confusing, and smaller facilities will probably not have as much of an issue with this as larger ones. Still, it’s good information to have in case you are struggling with uncollectible accounts receivable that need to be removed from your books.

Payments for Your Building: Lease or Rent?

The question of renting versus buying doesn’t just plague individuals and families, but businesses, too. There are a few main differences you should consider if you are on the fence about buying a building for your Florida daycare center.

When you are leasing a space, all of that payment can be deducted from your income as an expense. For example, say you are renting your facility for $7000 per month; the full $7000 can be expensed.

If you are paying on a mortgage, however, only the interest portion of your payment will be deductible. With the same $7000 payment (which would get you around a million-dollar loan, depending on rates and term), around $750 is going toward principal and $6250 is for interest at the start of the loan. So, only the $6250 can be expensed. This does not make a huge difference in the beginning since the interest portion is so high, but as you get more into the loan, it will have a greater impact, so it is an important distinction that must be mentioned.

When you have a mortgage, while you can’t deduct the entire payment as an expense, you are absolutely adding value to your business by owning an asset that has value in and of itself. The principal portion of the payment reduces the liability you owe (the mortgage), slowly but surely.

Another benefit of buying is that you can take an expense in the form of depreciation each year. Commercial property is depreciated over a period of 39 years. For a million-dollar building, straight-line depreciation over 39 years comes to over $25,000 per year in depreciation expense.

Combining these, if you are paying $7000/mo for a lease, that is $84,000 you are expensing each year. If you have a mortgage, you have around $75,000 in interest expense in the first year for that million-dollar building, PLUS the $25,000 for depreciation, totaling $100,000 in annual expenses to offset your income.

One major reason to not purchase a building is if you are unsure if you will want to stay in business for the foreseeable future, and if you’re not able to afford a down payment for a building at that price (which is completely understandable as a small business!). You also may not have the creditworthiness just yet but maybe you will after being in business for longer. And, perhaps you would rather have a landlord responsible for fixing things and doing major maintenance that comes up. Both options are valid from a business perspective.

Outsourced Accounting for Florida Daycares

Daycares have many of the same accounting headaches as other businesses, but there are a few issues that are specific to childcare centers. They don’t have to be a challenge to solve, however. We covered a handful of these in this article: itemizing different streams of income, categorizing your expenses to see where your money is being spent, handling accounts receivable, and the pros and cons of purchasing a daycare facility instead of leasing space.

One additional item I should note is that for in-home daycares, business use of the home is deductible to a greater extent than other types of at-home businesses! The IRS has some great tips for in-home daycares to use to prepare for tax time relating to this issue as well as meals you provide.

If you would rather focus on what you do best – serving children and families – consider outsourcing your bookkeeping and accounting. Start by getting a price estimate through my new quote calculator, and then if you’d like to proceed, schedule a quick call so I can answer your questions and get everything finalized. I can take this over for you in less than a week, giving you back your time and allowing you to rest easy on your days off, knowing your accounting is in good hands.