Here’s a little behind-the-scenes info on how QuickBooks Online works on the accountant side: We can find out your transaction volume in a few mouse clicks. I don’t know why they didn’t make this feature available for all users, but at the time of this writing, only accountant users can access this info.

However, I have a trick for how you can find out the transaction volume for your own QuickBooks Online file. This comes in handy when you’re looking to hire a virtual accountant to handle your bookkeeping, without having to immediately hand over accountant-level access to a stranger.

What counts as a transaction?

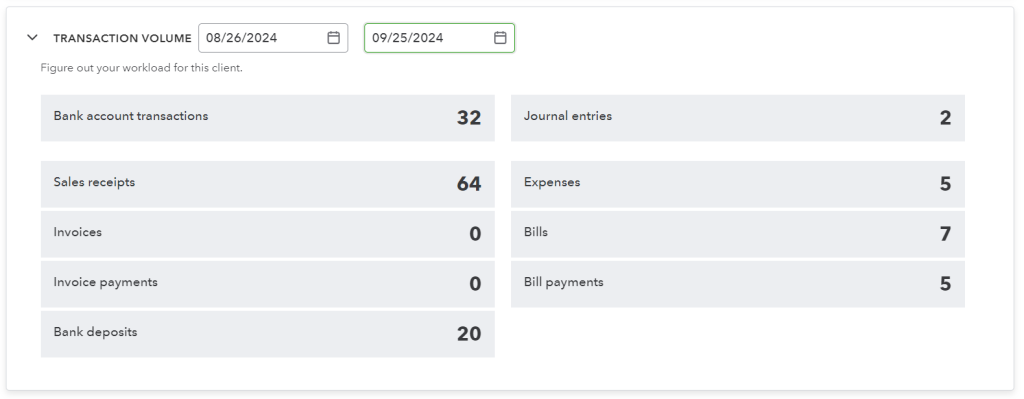

First, let’s talk about what I mean by “transaction.” Take a look at this screen shot, and you can see what QuickBooks defines as a “transaction.”

This is the view an accountant user has of your QuickBooks Online file. I can add each of these up and determine that over the last month, this client has had 135 transactions. This includes:

- Sales receipts created

- Invoices sent to customers (this particular customer uses a different software for invoicing and receiving payments)

- Payments received for those invoices

- Bank deposits entered (could be physical or from the merchant processor)

- Expenses entered

- Bills received from vendors

- Payments made to the vendors for those bills

- Journal entries

- All items brought over through the bank feeds that must be matched to the above. These are not transactions in the true sense, but this is a required process that makes reconciliation MUST faster each month and provides a way to stay on top of what’s going in and out.

I would also add that the less common transactions are not shown here. Refunds given, transfers between accounts, credit card payments, purchase orders, etc. are not included on this. This is not a foolproof way for us to estimate the transaction volume for a client for this reason, especially for certain industries; however, it does give us a lot of insight into the main things a business is doing so we can give an accurate estimate for services.

A more involved diagnostic review of your books will almost always be employed before giving an exact quote. But when we are aiming for just a ballpark estimate, this works just fine.

Using the Audit Log in QuickBooks Online

What we accountants have that you also have, as the business owner, is the audit log. You can access this by logging in, going to Reports on the left menu, and clicking on Audit Log.

When I do this for the client pictured above, I can scroll to the bottom of the page and see that there were 420 items on the audit log for this time period. That includes all of the above that I mentioned as well as anytime I logged in, added a new product or service, added a customer or vendor, voided something, emailed an invoice or receipt, edited something, matched something from the bank feed, and also when the bank feeds automatically updated (approximately once every day or two, for each individual account such as for your checking, for your savings, for your credit card, etc.).

So, this is obviously going to cover more than just actual transactions going in and out. In my experience, the actual transaction volume is somewhere around one-third of what the audit log reflects. So, our number of 420 items in the audit log would equate to about 140 transactions. And guess what – the actual number is 135 (as shown above on my accountant view), so this does come really close, doesn’t it?

If you are using my instant price quote calculator, take a look at your audit log and divide the number of items by three, and that’s the number you’ll enter on the second screen of the calculator when it asks for your approximate transaction volume. Give it a try!

What other factors go into the price of bookkeeping and accounting services?

There is a lot more that goes into the services I provide; I’m not just doing data entry, after all! If you’re just looking for data entry, you’d be better off doing it yourself or training an employee to tackle this for you.

Tasks

When you are filling out the questions in the price calculator, it asks about:

- accounts receivable

- accounts payable

- compliance

- paying employees and contractors

Complexity

We have to consider not just the tasks to be done but the complexity of the work, which obviously requires a higher level of expertise. This might involve:

- accruals for customer deposits

- entering daily sales information from your POS system (which breaks down your gross sales, sales tax, fees, tips, etc.) – and yes, this actually does need to be done daily in order to spot problems more easily

- having more than three accounts to reconcile since the work compounds exponentially when you have multiple accounts to deal with

- manually having to enter bank transactions and do reconciliations without the assistance of the automated bank feed, which incurs a fee as well. Note that the bank feeds are NOT considered AI; this is more like machine learning plus a trained human eye to review what the machine “thinks” is correct and fixing it when it’s not.

One-time Fees

Lastly, there are some one-time fees to be aware of. All clients incur a setup fee which ensures that your Chart of Accounts is set up correctly and I verify that all the various settings for your company are correct (and fix things that are incorrect). If you’re not already a QuickBooks Online user, this fee covers getting you set up correctly the first time.

The other one-time fees you might incur relate to getting the rest of your current fiscal year up to speed. This might mean:

- recategorizing transactions, so the more transactions you have, the longer it will take and the more skill it requires to untangle the mess

- doing reconciliations for prior months

- fixing data that is incorrect or reconciliations that were not performed properly

- redoing credit cards that were set up as banks (they are liabilities, not assets!)

- investigating old uncleared transactions

- fixing accruals that were not properly allocated

You can get quotes for these using my calculator! Understand that it’s meant to be a ballpark to determine how to budget for the accounting services your small business needs. You will receive a customized quote and a scope of work to ensure we’re on the same page before getting started.

Ready to outsource the accounting for your Florida small business?

As a business owner who has done the hard work of establishing your business in Florida and growing it into something successful, you might be looking to cut back on the administrative side of things so you can focus on operations or continuing to grow your business. It’s completely understandable if the first thing you want to get rid of is the accounting!

The first step is to check out my instant quote calculator and get a ballpark estimate for how much services will run your business. The next step is to schedule a quick call with me to review everything and allow me to answer any questions you may have. If you do already use QuickBooks Online, I’ll need to be assigned accountant access so I can check everything out and send you an exact quote for the work to be done. Assuming all is good, we digitally sign some paperwork and I can get started!