The P&L: The pièce de résistance of small business financial statements. (That’s about the only time you’ll see me speaking French, by the way.) Also known as the Income Statement or Profit and Loss, the P&L is THE report you need to be running each month to see how your business is doing.

Let me preface this by saying that you have to be inputting your financial information correctly if you want your reports to be accurate. If you are miscategorizing everything in QuickBooks, if you have credit cards set up as banks instead of as liabilities, if your books are incomplete…your reports will also be incorrect. As the saying goes, garbage in = garbage out. Don’t be that person; be that business owner who does care about accuracy. How else can you really make decisions if your reports are not right?

Back to what I was saying. When you’re a new business owner who has never really had to make major decisions or rely on financial reports to guide your path, a P&L can be overwhelming and confusing to look at. Let’s take a look at a sample and go over some pro tips to help you understand it better and use the software correctly.

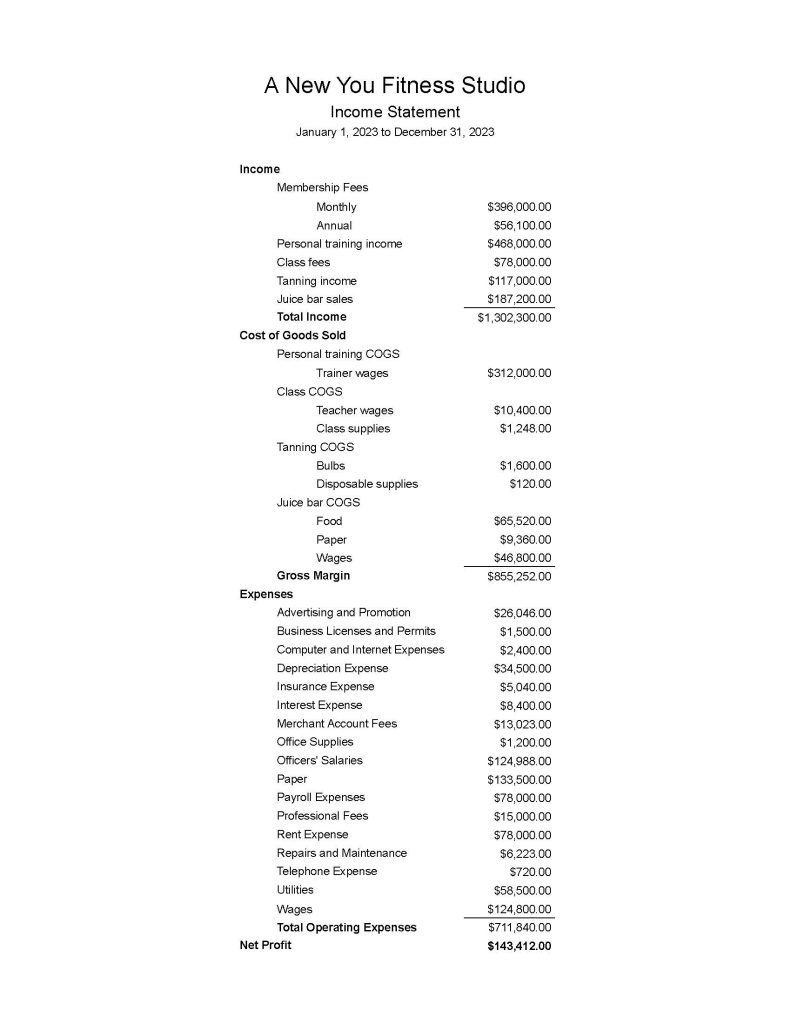

Here is the P&L we will be examining in closer detail – we will pretend it belongs to your business, and you’re my fictitious client. This is how it will look when you run or print the report, with some variation based on how your particular (real) company is set up. Okay, it won’t look exactly like this since this is just a sample I made in Google Sheets so as not to reveal real company data. (And I did make a mistake when I was making this. Can you spot it?)

P&L Heading

The heading is the top section that tells you what you’re looking at. It contains:

- the company’s name

- the name of the report

- the period the report covers

That third bullet point is the most important. Remember that a P&L always covers a certain time period – usually a month, quarter, or year. The numbers reflected on the report will look vastly different if you’re looking at a month versus the full year, right? So, you need to pay attention to the time frame you’re looking at.

Pro tip: Sometimes QuickBooks defaults to a random month for these, so be sure you always set the dates correctly and then run the report again.

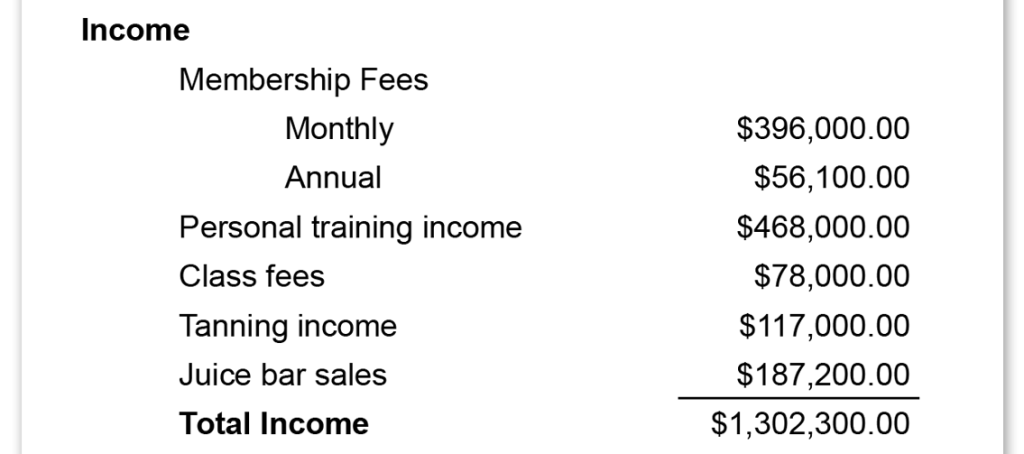

P&L Section 1: Income

The top section of your small business P&L details your different income streams and how much you earned from each. Our sample contains multiple areas where your gym can make money. They are pretty well diversified, although clearly some income centers make more than the others.

What jumps out at you when you first see this?

Here are some things that I see:

- income from members on monthly payment plans far exceeds those on annual plans

- people reallyyyyy value the personal training (what do they value about it? A good business owner would want to ponder this)

- classes may not be as important to people, or the price point isn’t right (lots of classes but very low priced; not many people taking classes because the price is too high)

- the tanning bed(s) and juice bar offer a nice supplementary income

The report is even more meaningful if you run it month over month or year over year. This allows you to compare and you can see if you’re doing better or worse than prior periods. You can spot trends in your income; for our gym example, you might see a spike in new memberships in July when it’s too hot outside to go for a jog (or really do much of anything!). However, the tanning fee income might drop some since, ya know, it’s summer.

Income should generally be trending upward when you compare things year over year. You preferably want your revenue to keep pace with inflation, at minimum. While it should always be a goal to attract more users to your business, you may have to raise your prices from time to time. It’s important to try to understand the “why” behind the numbers so you can pinpoint how to raise sales if there is a problem.

Pro tip: You can best set this up by using products and services in QuickBooks. It will map to your POS software and sync to record daily sales, hopefully. Not every POS system offers an integration in QuickBooks Online, but if yours does, you will need to set it up correctly so the entries are brought over properly. Go to Sales on the left menu and find Products and Services – you can set things up there. It should align with whatever is in your POS system.

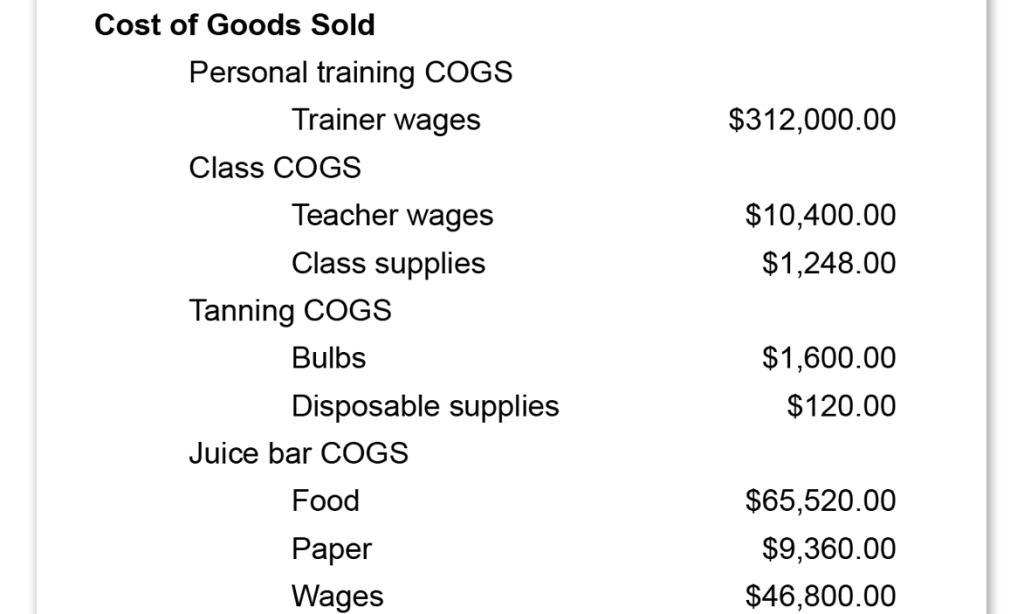

P&L Section 2: COGS

Not every business will need the next section. Cost of goods sold, better known as COGS, is for businesses that sell products that cost the business something to begin with. Restaurants, retail shops, manufacturers with raw materials…these owners will all see a COGS section which reflects the cost incurred when those inputs came into the business in the first place.

What jumps out at you when you first see this one?

Here are some things that I see, since I understand my fictitious client’s business after working together for awhile:

- first notice what is not present – membership COGS – the entire operation centers on selling memberships, so there is no additional COGS in offering this

- the only cost involved in selling personal training is paying the trainers

- for classes, the teachers must be paid but there are also some expenses associated with ensuring they have what they need in order to teach (mats, perhaps, which have a limited lifespan…maybe investing in more durable mats would be a good option I could recommend to my client)

- tanning has minimal expenses associated with it since the front desk staff man the beds and clean them after each use – this revenue center is hugely profitable

- the juice bar has a lot of costs associated with it, but it’s a nice perk for members and helps employ local teens

Let’s focus on the juice bar for a minute to give an example of how COGS works. If a green smoothie at your gym is comprised of bottled apple juice, fresh pineapple chunks, a handful of kale, a handful of spinach, and a half a scoop of protein powder, the purchase price for that exact quantity of ingredients comprises the COGS for that smoothie. It can become VERY overwhelming to figure out the exact price for each menu item (AND – a smoothie may be offered in different sizes and people will want different flavors, maybe a customer wants double the protein or a shot of a vitamin syrup, etc., and we may have some spoilage to account for). You should be able to ballpark it, though, and that is an important task when setting your prices to begin with (do you need to upcharge for special ingredients? how much should each size increase cost?).

Service businesses have a similar way to reflect the cost of what they sell; it’s called COS or cost of sales. For me as an accountant, I usually include the cost of the client’s QuickBooks Online subscription in my fee, so this is a COS for me. I don’t really have any other direct costs involved in what I’m selling since what I’m selling is my expertise.

Some businesses do include labor in their COGS, and this is subjective and will be up to the business owner as far as what they want to see. Restaurants typically do include labor cost, but many other businesses don’t.

Pro tip: A rule of thumb is that if it’s only a cost incurred in order to produce the thing you sell, it’s a COGS (or COS). One might argue that employees wouldn’t have a job if not for the product you sell, so sure, you can include labor in the COGS section. But how far do we take that? Your office manager likewise would not have a job if you didn’t have a product to sell, so it can become a slippery slope and therefore, I personally like to keep labor out of COGS. I included it here, though, to illustrate direct costs for different profit centers; it is probably a good idea for your gym, our sample company, to include labor in COGS.

Gross Margin

Your revenue minus your COGS or COS will give you your gross margin. This is how much you made after subtracting your direct costs. Here is where the error is: I did not total the COGS but instead just brought down the gross margin. Oops.

![]()

You can itemize this out with our smoothie example. If you charge $8 for a large green smoothie, and you have determined that it costs you $2.50 in food and paper costs for the ingredients, cup, and straw. That leaves a gross margin of $5.50 for that smoothie.

A restaurant operator might include labor here, which usually is around 30% of sales (give or take a few percentage points), and this is not something you’re going to manually calculate in your COGS but rather calculate after the fact based on how much labor you used and how much sales you had in that period. Thus, 30% of the $8 smoothie is $2.40, so take that off as well. You are now left with a gross margin of $3.10 for the large green smoothie.

What decisions can you make – or should you be making – when you evaluate gross margin? It would be especially helpful if we did this for each of the profit centers (membership, personal training, classes, tanning, juice bar) but for the purposes of this article, we can nutshell it by dividing out the percentage margin for each (and QuickBooks absolutely can do this, but I didn’t do it for our spreadsheet example). We can calculate it like this:

Gross margin = (sales – COGS) / (sales)

For your gym, they are as follows:

- Membership: 100% – this is not really accurate since the membership fees cover ALL the things the gym offers (and all the expenses incurred)

- Personal training: 33.3%

- Classes: 85%

- Tanning: 98.5%

- Juice bar: 35%

What this means is that for every dollar brought in from each of these, that much is going toward your bottom line (33.3 cents, 85 cents, 98.5 cents, and 35 cents, respectively).

This is a game changer in how you can view your business!! What do you think about each profit center now?

- Your members spend a lot on personal training, but the cost to the business is high since it’s paying for the trainers’ time and expertise. It’s not super profitable, but it probably does drive a lot of the membership revenue (people continue their memberships since they have a favorite trainer!).

- Classes might not bring in much compared to the other centers, but there is a darn good profit margin there. You could consider bringing in another person to teach, which could raise sales if you offer something other gyms don’t (such as salsa lessons).

- Tanning is a stupendous addition to the business. It was very smart of you to bring this on board. Do you ever have a wait time for using the beds? If so, you might want to add another standup bed or two and consider dedicating an employee to them during peak hours.

- The juice bar has typical restaurant margins. You feel it’s worth it to keep this in place as part of the value members receive, and you knew it might be a loss leader when you decided to add it. Maybe adding a grab-and-go display case with healthy snacks would pad your bottom line a bit here.

Pro tip: In order to see your margins for each profit center individually, you’ll want to set each one up as a class in QuickBooks Online. This is available in Plus and Advanced subscriptions. You are able to run a whole P&L by class and get the exact data you need! Otherwise, it will show you the gross margin as calculated using all your revenue sources instead of just comparing each individual center.

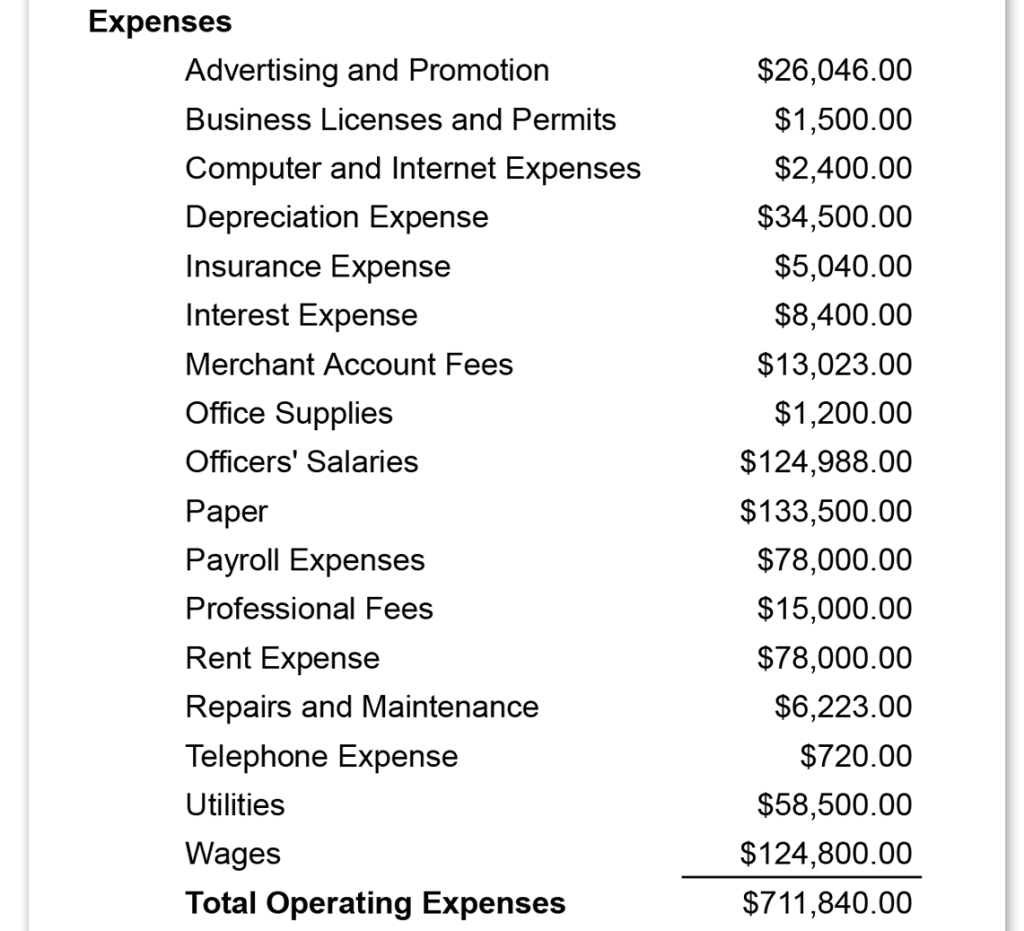

P&L Section 3: Operating Expenses

Everything else that is not directly tied to providing a product or service is considered an operating expense for most small businesses. These are your standard expenses like ads, insurance, website fees, office staff, payroll expenses, paying yourself as an officer, any interest on loans, rent, utilities…the list goes on.

Now that you’ve had a little practice, I’ll ask the same question. What jumps out at you when you see this?

Here are some things that I see:

- The expense for paper is quite high – this is probably related to stocking the bathrooms, keeping paper towels available to those who want to clean equipment, etc. Can you change suppliers for these products?

- Rent expense looks pretty good for such a large facility – I’d advise you to keep that lease as long as possible!

- The depreciation expense indicates to me that you have a good amount of equipment you’re depreciating still, and the interest expense tells me you probably financed at least part of it

- Those tanning beds use a lot of electricity! Along with the air conditioning. There’s not really any getting around that, but it does indicate that the tanning beds are not quite as profitable as we’re led to believe when looking at COGS and gross margin alone.

- The employee wages cost you about 27.6% of the revenue from membership fees. You can look at it this way since the labor for each profit center is under COGS, and all other wages would be related to running the gym itself. This is a pretty good labor percentage (try to always keep it under 30%).

- Nothing else stands out as high or low, which tells me that you as the business owner have a good handle on what you’re doing!

The longer you stay in business, the better you will get to know your specific niche and what kinds of costs you’re looking at. It could be helpful for you to join professional associations that help you understand the business side of your profession. As a Florida business owner, it’s not enough to just be good at what you do – you need to be able to run a business, too. A competent bookkeeper or accountant can help you out here when you’re new.

Pro tip: You may have sub-categories for some of these things – in fact, I encourage you to break out large categories such as advertising, insurance (if you have multiple types), computer/website expenses, your specific types of utilities, etc. You can do this inside QuickBooks Online by adding a new account on your Chart of Accounts. Be sure to set it up properly – select Expenses on the dropdown and be sure to check the box for it being a sub-account of something else…and then choose which account you want it to go under.

Income and Expenses Not from Operations

While not shown here in the sample, some companies have additional revenue from investments and possibly some administrative expenses that are not classified as operating expenses. This section is typically shown after net operating income.

Keep in mind also that every business will have a customized Chart of Accounts that may separate things out more or less than I have here. Restaurants in particular may utilize the Uniform System of Accounts for Restaurants (USAR) which has expenses divvied up into controllable and non-controllable types. It also utilizes some different terminology such as prime cost to describe revenue less COGS (which includes labor). All that to say, your business should be set up in QuickBooks Online so the data make sense to YOU as the owner.

The Bottom Line on the P&L

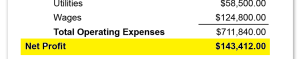

This is always where my eyes go first. It is literally the bottom line of the report, but it’s also the figurative bottom line when it comes to how your company is doing. The bottom line is what it all boils down to – the success of your company.

Shown on our sample report is a profit of $143,412 for the year. Nice! You can use this to pay yourself or to pay extra toward any loans, or to keep within your company as retained earnings.

Note that this is the amount you’ll be taxed on. I briefly go over taxes by entity type in my Florida small business startup guide, but to summarize, a corporation will pay corporate taxes on this amount, and any other entity (sole prop, partnership, LLC, S-corp) will have this amount pass through for the owners to claim on their personal taxes, in accordance with the percentage ownership of each partner.

For pass-through entities, what you do with this money does not matter – you can take it out as a distribution, you can keep it in the business bank account, you can apply it as principal to a loan…and you will pay taxes on it.

Corporate owners would pay their corporate income taxes and the rest of the money would stay in the bank account (as retained earnings) unless it’s distributed as dividends to the owners, in which case THAT portion is taxed on the owners’ personal returns.

Either way, congratulations, your small business was profitable this year! Time to look ahead and see how you can make that even better for the next year.

If the number shown here was negative, I’m sorry but that means you have work to do. A negative number means you lost money. You will need to raise your sales and/or control your costs better. The time to make these changes starts NOW! A continual loss year over year means your company will go bankrupt, and nobody wants that.

Pro tip: Look.here.first. It will prepare you for what you need to look for as you review the rest of the report.

Outsourcing Your Small Business Accounting

Now that I’ve walked you through some things to look for on your P&L, what questions do you still have? Is it clear as mud or do you think you have a good handle on this? It takes practice, so keep at it. Your future self thanks you.

If you decide you don’t have time for all the bookkeeping and would prefer to just see reports and talk with an advisor each month so you can focus on implementing changes at the operational level, try out my instant quote form. We can then have a short call so I can answer any questions and go over your particular needs based on where you currently are and where you want to go. I can have this off your plate in under a week if you’re ready!