In your daily operations, your P&L (Profit and Loss Statement) gives you a lot of insight into how your small business is running. I want to introduce you to the Balance Sheet – another very important report that you should be looking at monthly. The Balance Sheet shows how much your business is actually worth, and it goes hand in hand with the P&L in that the net income calculated on your P&L goes into the preparation of your Balance Sheet.

Small businesses don’t always have a lot of assets or loans, but other things like your bank accounts, credit cards, and the capital investments you’ve made into your business are all listed on the Balance Sheet. Therefore, you should take the time to get to know this report and use it in your business. In this article, I’ll also explain a few ways in which this financial statement can benefit small business owners.

The Fundamental Accounting Equation

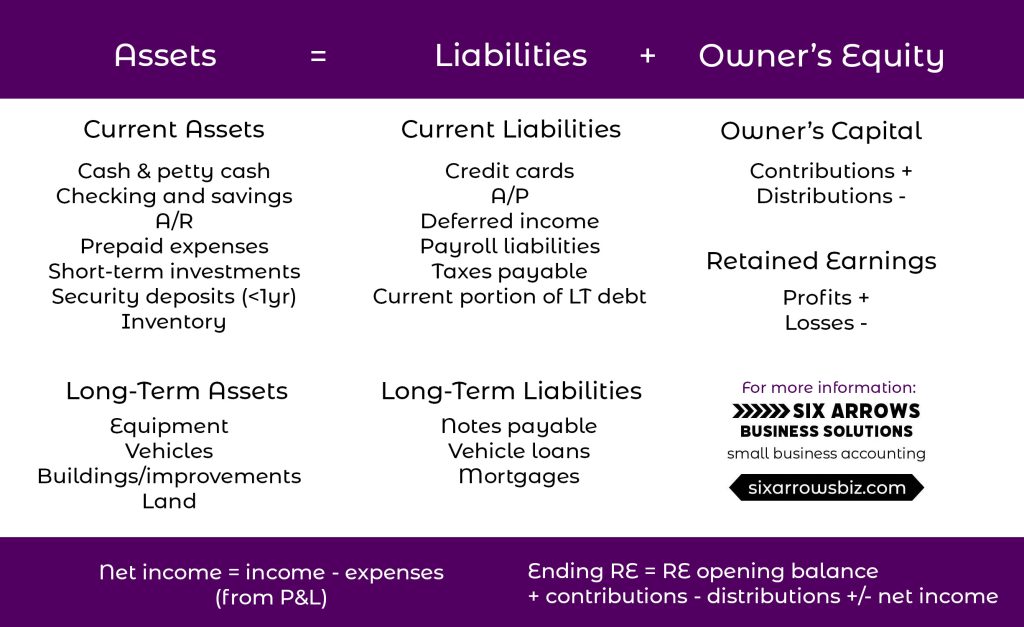

Every accounting class I’ve ever taken relied upon the student having an understanding of the accounting equation. It looks like this:

Assets = Liabilities + Owner’s Equity

You could also write it like this:

Assets – Liabilities = Owner’s Equity

Another way of saying this is that there are things you own that give your business value, and after subtracting out what you owe to others, the rest is left for the owners. That number represents the true value of the business – its net worth.

This is different from how much your business makes. Both are important!

Why should a small business owner care about their Balance Sheet?

It is important to remember that the Balance Sheet is a snapshot taken at a single point in time. If you make a loan payment tomorrow, or place a new asset into service, your financial picture will change. This is in contrast to your P&L which shows income and expenses for a period of time – usually a month, quarter, or year.

Debt repayment is not an item on the P&L beyond the amount going to interest expense. The part of your payment going toward principal does not hit the P&L! This is a very common point of confusion. In order to see the full picture, you must look at the liabilities section on the Balance Sheet.

Another reason you should be looking at the Balance Sheet is to visualize how much depreciation has been taken on assets. Depreciation is a bit of a complex tax matter in that it represents a non-cash expense that does go on your P&L, but your total accumulated depreciation offsets the value of the corresponding assets on the Balance Sheet, too.

All that to say, examining the Balance Sheet can give you insight into cash flow and help clarify some of these items that do hit the P&L. I don’t personally love the Statement of Cash Flows for small business owners, and I feel just the P&L and the Balance Sheet can suffice for a complete picture of your business. You can optionally add in reports such as A/R Aging and that kind of thing to help you stay on top of any potential cash flow issues.

All About Assets

Let’s dive in and look at assets first. An asset is defined as something you own that helps you operate and grow your business. Ownership of these things offers the benefit of future use in order to produce income. The items in and of themselves have value, too (sometimes it’s just utility value! but nevertheless, a value that can add to the net worth of your business).

There are a few common categories of assets for small businesses:

- Cash and cash equivalents

- Bank accounts (checking, savings)

- Investment accounts (short-term accounts like some CDs or a money market account)

- Petty cash and/or cash on hand (such as in a till)

- Accounts receivable or A/R

- Prepaid expenses (e.g., you paid your annual insurance premium in full)

- Security deposits

- Inventory

- Equipment and vehicles

- Building, including the build-out

- Land, including development costs

- Intellectual property and goodwill (intangible assets)

You’ll notice that some of these are easier to access than others. The top part of the list represents what we call Current Assets in that they are liquid and their benefits will be used within a year. I’ve ordered them from most liquid to least liquid; it’s obviously easier to get cash out of the bank than to sell off inventory, for example.

The bottom part of the list is much more difficult to convert to cash and typically is intended for use over the long-term…thus, we call them Long-Term Assets. You may also hear these referred to as Capital Assets, Fixed Assets, or Non-Current Assets.

We also have what’s called a contra-asset account with accumulated depreciation (and accumulated amortization if you use it). This should always be presented as a negative number with the word “Less” involved so it’s abundantly clear when you’re looking at your small business Balance Sheet. We will cover an example of this further down, but for now, just understand that this amount decreases the book value of the assets.

Looking at Liabilities

Anything you owe to others is a liability. It usually refers to money that is owed in exchange for something (often an asset), but sometimes it represents a service or product such as when a customer puts down a deposit for future services. These take away from the value of your company.

Liabilities are similar in how they are categorized – some loans must be paid in the short-term and these are called Current Liabilities. You also have Long-Term Liabilities that are paid over a longer period. Here is a list of typical liabilities that a small business might have:

- Credit cards

- Deferred income (customer prepays for something and you owe them a service or product)

- Accounts payable or A/P

- Other short-term debt such as the part of your long-term debt that will be paid within the next year

- Vehicle loans

- Other notes payable

- Mortgages

It should also be mentioned that most small businesses have some kind of tax liabilities to account for. This could be sales tax payable (you collected this over the course of a month and have to remit it to the state), payroll tax liabilities (all the FICA, etc. that you withhold must be remitted to the Department of Treasury periodically), and even the payroll itself is a liability until it is actually paid out!

The Tricky Part – Owner’s Equity

Owner’s Equity is less straightforward. Remember that we can look at the accounting equation a second way: Assets – Liabilities = Owner’s Equity. This probably makes more sense to a business owner; what is leftover after subtracting debts from things that are owned is how much the owner really owns of his company.

There are two sections to consider for the Owner’s Equity portion: Owner’s Capital (also just called Owner’s Equity) and Retained Earnings.

Owner’s Capital

The Owner’s Capital portion has an account for each partner if it’s a partnership (including a multi-member LLC) and just one if it’s a sole proprietorship (or single-member LLC). Corporations do their capital structure a little differently since they issue “stock” (and I’m not meaning a publicly-traded company…this is more complex and for the sake of this article, I’m not going to address this since most small business owners use the LLC option).

Within each account, there is a Capital Contributions account which includes the money each owner has put into the business that year. This might be the initial injection into a new business, and it might be something an owner paid for out of his personal money that is a legitimate business expense (AND does not get reimbursed). These contributions increase the basis of that owner in the business. This part is relatively straightforward – it’s just the money each owner has put in.

Likewise, the money each owner has taken out of the business is factored in. We put this in an account called Owner’s Distributions and it offsets the contributions. The effect is decreasing that owner’s basis in the company. This could happen with distributions that are intentional, but if an owner accidentally uses the company card for a personal expense, that could be considered a draw rather than asking the owner to pay it back.

These two accounts are closed into the main equity account for each partner at the end of the year.

Retained Earnings

Retained Earnings is a little bit more confusing. This is intended for use within the company and is not distributed to shareholders, but this accounting concept as typically taught is in reference to corporations. The average small business owner in Florida is operating with an LLC, and the earnings all pass through to the owners for taxation. What you do with “retained earnings” doesn’t even matter as you will be taxed on it no matter what. You can take it out and keep it, you can leave it in your business bank account, you can apply it as a principal payment to any loans…you’ll pay the same taxes on it unless you utilize it for a legitimate business expense.

Back to what I was saying. Your net income becomes a “plug number” and adds or subtracts from the net worth of the business. You can calculate Retained Earnings by starting with the beginning RE balance (which will be $0 if you’re a new business), add or subtract your profit or loss for that year, subtract any distributions to owners, and that’s your ending RE.

Under the Owner’s Equity section, the main thing to remember that anything going out to the owners and any kind of loss the business experiences will decrease the net worth of the business, lowering Owner’s Equity. Any capital injections and profits coming into the business will increase Owner’s Equity, thereby increasing the net worth of the business.

Connecting the P&L to the Balance Sheet – Income and Expenses

As I just explained, the bottom line on the P&L is a “plug number” that goes into calculating Retained Earnings. Let’s think about this for a minute. If you have a profit for that year, your equity in the business increases, right?

On the flip side, a loss for the year decreases equity. Preventing it from continuing is what you need to focus on in that scenario.

Business owners understand the very basics of the P&L – income increases the bottom line and expenses decrease it. Simple! When you look at it that way, you can see how Owner’s Equity is increased by income and decreased by expenses. This plays into the accounting equation and is a basic thing that any bookkeeper or accountant needs to understand in order to properly do the books for a business, but also in order to explain to business owners how their actions affect both the P&L and the Balance Sheet.

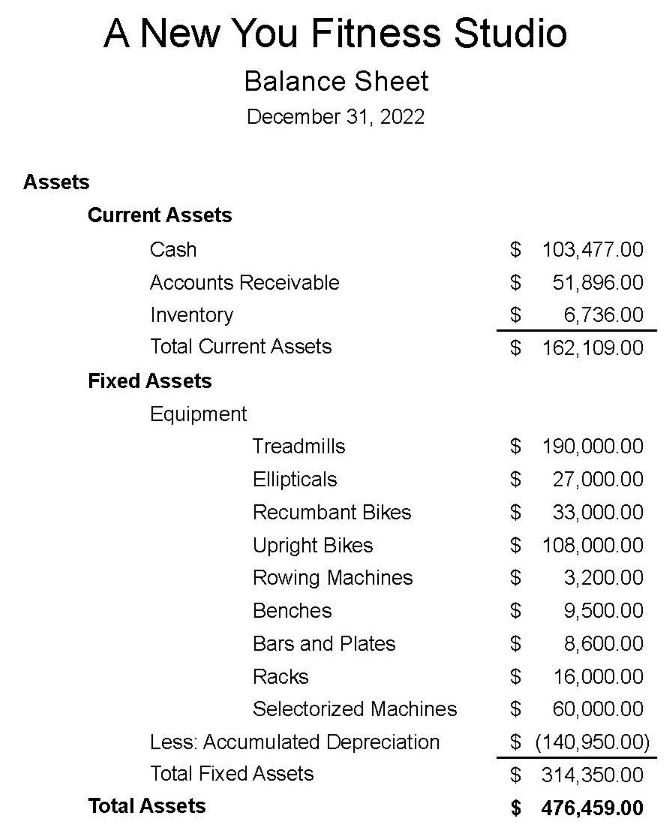

Small Business Balance Sheet Example

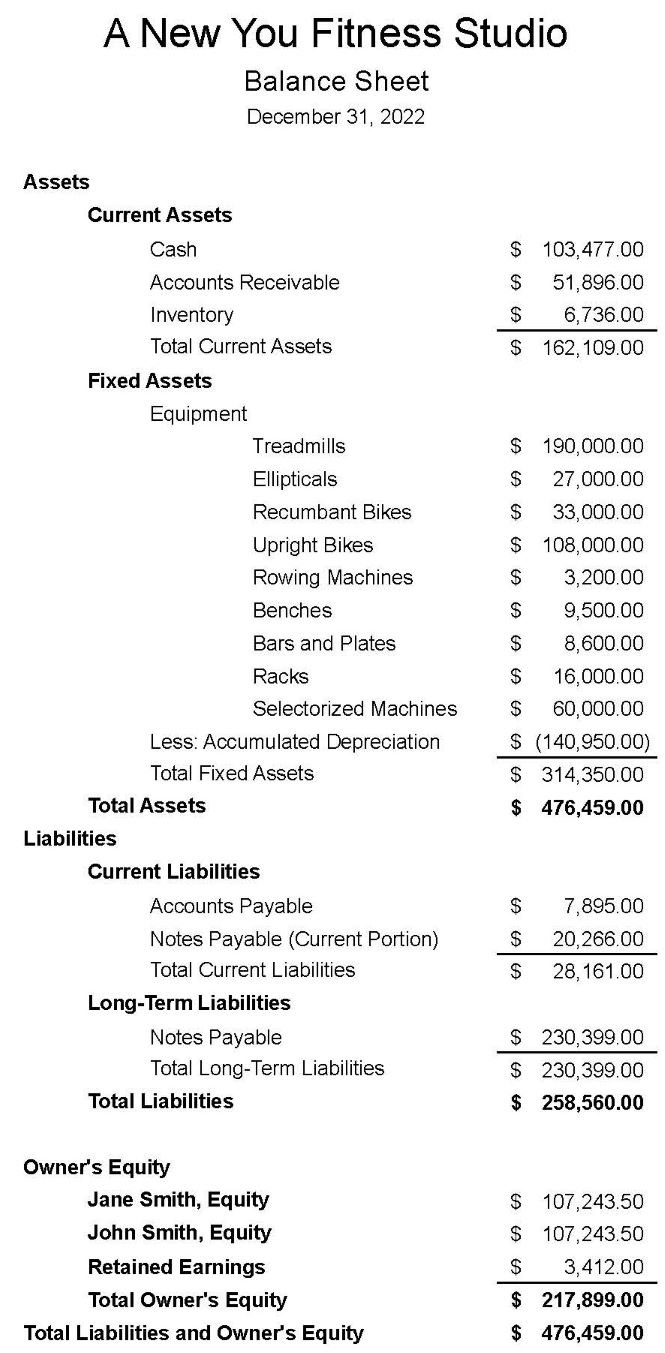

Let’s look at at our gym example (I covered the P&L in another post) to illustrate these concepts, keeping the accounting equation in mind (A=L+OE). Also note that your entity type does factor into the specific verbiage used, but the concepts are the same.

First and foremost, note the date at the top. This Balance Sheet was prepared on the last day of the year. We can expect that the tax preparer will have an adjustment for depreciation, and we will close out the owners’ contribution and distribution accounts to their total equity the following day to start those accounts fresh for the new year.

Next, you’ll see the assets listed in the first section, divided into current and long-term. Accumulated depreciation is presented to offset the assets. Keep in mind that this is not necessarily indicative of market value; it is simply to reflect the current book value of the assets and how much they contribute to the total monetary value of the business for accounting purposes.

Liabilities are after the assets and are listed in the same manner, with short-term liabilities first and long-term after that.

The Owner’s Equity section is last and shows our LLC’s two owners. We used the net profit from our P&L ($143,412.00) and QuickBooks automatically reduced it by the $70,000 each owner took as a distribution over the course of the year (minus $140,000 – I arbitrarily picked that number for this example), which leaves our Retained Earnings pretty minimal this year ($3412).

Going back to the accounting equation, you’ll notice that the assets are equal to the liabilities plus the owner’s equity. If your accounting equation doesn’t balance out, we have a problem! It means something got messed up in your bookkeeping. Usually this is something set up incorrectly rather than a numerical type of error. QuickBooks does try to fix these when calculating the retained earnings so sometimes, it’s not immediately obvious that there is a problem, and this is where experience really helps.

Permanent and Temporary Accounts

One last note about the Balance Sheet is that the accounts listed on it are permanent accounts, with the exception of the contribution and distribution accounts for each owner, and those get closed out at year-end to reflect the amount of equity each owner has.

In contrast, the accounts on the P&L are temporary accounts that are closed out at the end of each year to create the net profit or loss. These start fresh on the first day of your fiscal year.

This helps explain why the Balance Sheet is a snapshot in time versus the P&L which is always viewed over a period of time, such as a month, quarter, or year.

I will leave you with this cheat sheet. Feel free to download it and reference it when you need a reminder of how to read your small business’ Balance Sheet.

Florida Outsourced Small Business Accounting

If you own a small business in Florida and need some assistance with these more confusing aspects of entrepreneurship, let’s take a look at how I might be able to help you. I’m able to take on all the bookkeeping as well as A/R and A/P, payroll, state and federal tax filings…and the best part is that I don’t just send off reports each month for you to be confused by. I come alongside you to help you understand the numbers and how your business is doing so you can make the best decisions for your business.

I specialize in service-based small businesses that are in the earlier stages of growth. Check out my new instant quote calculator to get an estimate for how much my services will run your Florida small business, and when you’re ready, schedule a quick call so I can answer any questions and firm things up before getting started!