As a fitness center owner, your facility is most likely using newer tech to streamline enrollment, invoice your members, schedule classes, get members checked in, and even get statistics on churn, length of membership and more. While gym management software and practical hardware such as check-in kiosks have become more commonplace, are you maximizing their capabilities?

Said another way, are you able to glean information that you can use to make decisions about your business?

Accounting for gyms and fitness centers does involve accepting enrollment fees, setting up recurring ACH withdrawals, handling extra fees such as those for one-off classes, personal training, or products, and making sure everyone gets paid…but there is much more to it than the daily management type stuff if you want to have good data by which to make good choices when running your business!

We will cover a few different ideas here that can give you the necessary insights into your books and how you can best use this information as an owner.

Understanding Gym Income and Expenses

While the main goal of your business is helping people get fit and healthy, there are multiple ways in which you probably do that. Differentiating between your income streams and their associated expenses is the first step in getting better data about your business. Of course, you can lump all your income into one big bucket, but chances are, this figure is comprised of income from memberships, personal training, and additional services like tanning, product sales, or nutritional products. These all have their own expenses, so we need to get that differentiated, too.

Managing Different Income Streams

When you first set up your Chart of Accounts (that is, the hierarchy of categories that go on the Balance Sheet and Income Statement), it’s ideal to have these income streams listed out separately. This is what that might look like:

- Membership fees

- Monthly

- Annual

- Personal training income

- Class fees

- Tanning income

- Juice bar sales

The Chart of Accounts is unique to your business and I highly encourage customizing this to get the info you desire to see. You could add more categories under classes in my example, and maybe you don’t charge a separate fee for tanning…whatever your specific product mix is, that is what you’ll want to use. Additionally, if you don’t want to see as many nitty gritty details, you can choose to use fewer categories, but I still always suggest that small business owners have enough detail to give them helpful information about the health of their business.

You likely get a single bank deposit from your credit card processor every day or two; the easiest way to go about getting these details is to pull it from your POS system. So, it is imperative to get this set up properly, and if your POS system can integrate with QuickBooks Online, all the better! You can map the information from the gym software to the accounting software so the data is synced in your books, making it a little easier to keep it all straight rather than untangling the big deposits into your bank account, which don’t tell you very much information at all!

Accounting for Expenses

Now, some of these income categories will have specific expenses associated with them. While membership fees are your main source of income and they encompass pretty much all that you do, personal training will likely have a wage expense. Same for classes. Tanning income would have expenses associated with the beds and their upkeep, and obviously juice bar sales (or any type of product you sell) will have COGS, or cost of goods sold.

There are various ways you could set this up. I personally would want to see the labor for your trainers listed as a COS (cost of service, similar to COGS but for a service rather than a product) since personal training cannot be offered if not for the professionals delivering the service. I would consider wages for class teachers to be a COS as well. Note that it does not matter if your trainers are employees or independent contractors when it comes to this; it would be handled the same way.

Let me show you an example of how this might be set up in your gym’s accounting software.

- Personal training COS

- Trainer wages

- Class COS

- Teacher wages

- Class supplies

- Tanning COGS

- Bulbs

- Disposable supplies

- Juice bar COGS

- Food

- Paper

- Wages

(My assumption above is that you have an employee dedicated to just the juice bar, but if not, you’d not add the wages category there.)

For the other operational expenses, without getting too detailed, it might look like this:

- Rent

- Utilities

- Insurance

- Professional fees

- Wages (admin/support staff/management)

- Marketing and ads

- Repairs and maintenance

- Interest expense

Analyzing Your Gym’s P&L

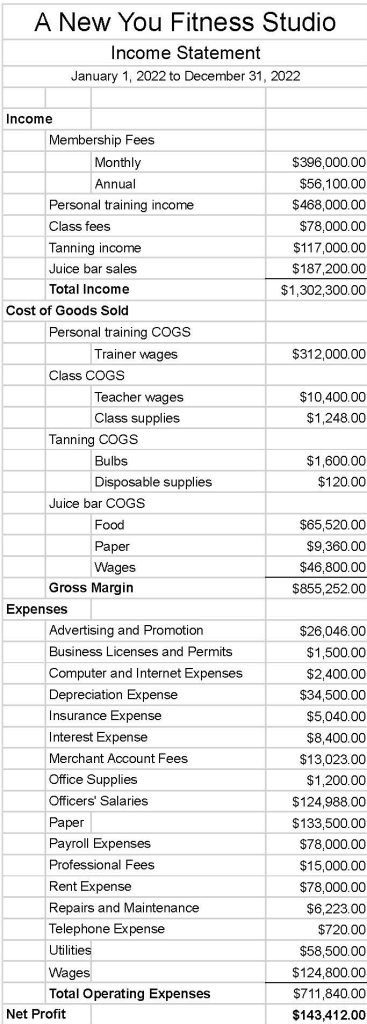

Here is a sample P&L for a fitness center. What kind of information can you get from this that will help you make decisions about your business? Note that this already assumes that a) all info is present and b) all the info that was entered is accurate! Getting the info entered will always be the first step!

When you run a P&L month over month, you can spot trends and anomalies. If your business is sort of running on autopilot, as is very common with small businesses, you might miss things like an insurance rate hike, or a lease renewal increase that you overlooked. You can also find cool things like higher revenue after implementing a new marketing strategy or hiring a new GM.

Likewise, when you run a report with the percentage of income displayed for each category, that gives you additional data. For example, your juice bar, however small it may be, should really not be running more than 30-33% food cost, so when that number is high, you’d want to do a few things – look into waste by your employees (improper portioning), possible spoilage, if food costs have gone up, and potentially raising prices if the cost cannot be controlled another way. There are industry standards you may want to use as benchmarks.

Your Gym’s Balance Sheet

Assets are used to generate revenue, and the equipment in a fitness center is a perfect illustration of this. As you’re well aware, much of your Balance Sheet is comprised of equipment – the assets themselves as well as any loans for them, which are liabilities.

Assets and Depreciation of Gym Equipment

In order to differentiate these at a glance when you’re running a Balance Sheet at any given time, I suggest making subcategories for the different types of equipment instead of putting it all under the general catch-all of “equipment.” This is what it might look like:

Do you see how this makes it a little more clear as to where the value of your assets is coming from? The spin class in the example better be adding a good bit of revenue! And we know that people expect there to be treadmills available for use at any given time when they go to work out, so you know those are a good investment, whereas the rowing machines are less costly and people aren’t necessarily signing up for the gym just to use a rowing machine but it’s still nice to have. Does that make sense? You can see where your money has been allocated when it comes to creating a product people want to buy – a membership to your facility.

You might also notice that we have accumulated depreciation offsetting the value of the assets here. Every year, the assets are depreciated via a non-cash expense (which has the great effect of reducing your tax burden!) to reflect how items do lose value over time. The rule of thumb is that anything over $2500 with a useful life of two or more years needs to be depreciated rather than expensed in the year of purchase. (Note that less expensive items like bars and sets of weights might be expensed instead of booked as assets; you would want to discuss this with your tax preparer to be sure of their preference, how it fits in with the current tax laws, and your specific tax situation.)

Section 179 Deduction

In addition, there is an IRS rule (Section 179) that does allow for expensing equipment in the year of purchase. Any computer systems you purchase can also fall into this category.

The main sticking point with Section 179 is that you must keep and use the equipment for all of its useful life or else you may be subject to what’s known as Section 179 recapture. This includes selling it, trading it, or business use of the item decreasing (i.e., converting it to <50% business use). When you use Section 179, you’re taking the full deduction up front in exchange for promising to keep the piece of equipment in play for its useful life (maybe seven years here in this scenario).

If you do not abide by that unspoken agreement, you’ll have to recalculate whatever the typical depreciation would have been and pay taxes on the difference (however you are normally taxed for your entity structure). So, I suggest really thinking about your business goals and consulting a tax accountant before taking this deduction.

Liabilities and Cash Flow for Gym Owners

Chances are you have a loan on some or all of your equipment. You may have also had to finance your leasehold improvements or build-out. These loans represent liabilities and offset the assets on your books.

This also represents one of the biggest issues a gym owner faces: cash flow problems. The loan payments are not considered expenses so the cash going out to make the payments will be more than whatever the actual expense is. You see, the expense part of it is the interest on the loan, while the part of the payment that goes to the principal is not part of what you can write off. It simply reduces your liabilities (the loan).

Say your payment is $8000 per month for a specific set of equipment you purchased, and of that, $7000 is for interest and $1000 is applied to the principal. It’s important to wrap your head around this so your cash flow isn’t affected. Planning ahead for bills needs to include looking at the full amount of these payments rather than just the portion considered an expense.

There is some good news – each year (or even each month), you can take an additional expense of depreciation as discussed above. This does help offset everything a little bit, but only on your books, so you still need to really focus on your true cash flow. This is the one time where a P&L can be a little less than forthcoming when it comes to getting all the info you need for those business decisions you are responsible for.

Payroll for Fitness Center Employees

I cannot end this article without touching on payroll and wages. You most likely have a combination of worker types in your gym business. You have hourly employees who work in administrative jobs or on the gym floor helping members, as well as salaried managers. But you probably also have independent contractors who do the personal training and teach classes.

Just how much control you exert over these workers will help you understand how to classify them – it is possible that they could be employees if you are telling them how to do their jobs. Ideally, a contractor will invoice you for the work performed rather than you tracking their time and paying accordingly. Make sure you get a W-9 when you start with a new contractor so there are no issues tracking them down at tax time to send that 1099. There is a way in QuickBooks Online also to track payments to them to make calculating the 1099 amount much easier!

It’s important to get this right as the IRS wants to make sure it’s getting its money from either you or them! So, if you purposely misclassify your workers as contractors in order to avoid paying payroll taxes, you may end up with heavy fines. This happens unintentionally as well, so I always advise business owners to think hard about this from the get-go.

Outsourced Accounting for Gyms and Fitness Centers

As a gym owner, you’re most likely pretty savvy with numbers and in general as a business person, but accounting stuff can be complex and difficult to wrap your head around. It also might involve tasks you don’t want to take the time doing when you could be spending that time on other business tasks that will result in additional income!

If you’re considering outsourcing your accounting, check out my new instant pricing calculator to get a ballpark estimate for the cost of accounting services. Then, if you want to proceed, schedule a 15-minute call to go over your needs and get answers to your questions. I can take over your books in under a week so you can focus on other aspects of your business or just have some extra down time.